Hedging is a type of forex strategy in the Forex market that enables traders to minimize the risk of their trades by using it. In hedging, it involves opening a new trade in the opposite direction of their previous trades. We will examine why hedging is a high-risk process and should be avoided.

Hedging, also known as risk management, is a commonly used practice in the financial industry to minimize losses. In the Forex market, when traders want to control the risk of a trade, they open a new trade in the opposite direction of the previous trade, with the aim of reducing the risk associated with the trade.

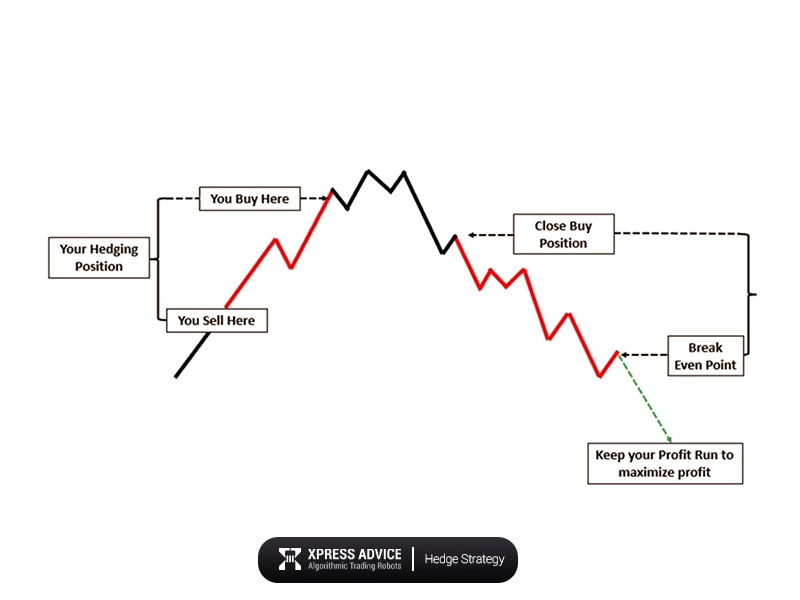

Consider a situation where a trader opens a Buy position on the GBP/USD currency pair. Suddenly, due to fluctuations, unforeseen events, or news, the market starts to fluctuate upwards, and the trader begins to incur losses. The trader may decide to open a new Sell position on the same currency pair to avoid further losses during fluctuations.

If the market continues to rise, the losses on the Buy position will be offset by the profits on the Sell position, and vice versa. However, it’s important to note that hedging is a highly risky strategy that usually results in losses. The hedging strategy is used in trading robots of the forex market, to read more you can read the article “hedging Forex EA“.

Many traders use reputable and professional trading expert advisors to increase their profits. By purchasing professional expert advisors in the Forex market, you can execute your trades with a minimum level of risk. If you are interested in learning more about the forex expert advisor, read the article “What is a forex robot?”

Overall, hedging has many different methods that most large companies and professional investors use to reduce risk in their trades. If you want to know about hedging accurately, we listed them below:

Besides those that have been mentioned, which are used in the economic system, the most important hedging strategy for traders is risk coverage.

Hedging may appear to be a way to minimize risk initially, but if you lack experience and expertise, you may end up being trapped in multiple trades without any way to exit without incurring losses. Therefore, we have come to the realization that hedging is not a profitable trading strategy. Although there are numerous Forex expert advisors available that rely on hedging systems for risk coverage, they are often not effective.

In short, hedge strategy can be a highly risky practice. Instead of hedge strategy , we recommend using trading expert advisor with the ability to trade effectively, which eliminates the need for a hedging strategy. Alpine is one such Expert Advisor that has a high potential for gains without resorting to martingale or hedging strategies.

Xpress Advice has developed Alpine, an advanced EA that is currently one of the most up-to-date in the Forex market. This EA doesn’t need any personal management because it automatically monitors all market conditions, including news and financial management, as well as stops loss and profit limits.

Hedge strategy in the Forex market can have both advantages and disadvantages. To use this strategy effectively, you must be a professional; otherwise, you may lose your capital and increase your losses. In this article, we will examine some of the advantages and disadvantages of hedging strategy in the Forex market.

Ultimately, successful hedging requires a combination of knowledge, analysis, and strategic thinking. By taking the time to learn these skills and apply them effectively, you can have a successful trade. also do not forget to test the demo version.

To successfully hedge, traders need a well-devised strategy.

Professional traders use various methods, which we will explain in the following paragraphs:

The first strategy is known as ‘fully hedging’. This involves opening an opposite trade for a short period of time to prevent potential losses in a long-term trade. For instance, if a trader has opened a long-term position for a few days in EURUSD, any sudden news or event may cause a short-term change in the trend of their trade.

In such cases, traders can always make small profits by opening trades in the opposite direction of their main trade for a short period of time. This helps to prevent any losses that may occur in their main long-term trade.

Professional traders use a variety of methods for hedging, and one of them is called Hedging Correlation. This strategy involves opening a BUY trade position in EUR/USD and simultaneously opening a trade position in the opposite direction on another currency pair that has a high correlation with EUR/USD. The purpose of this method is to minimize the risk of losses caused by market fluctuations.

If the correlation is positive, the trader will open a trade in the opposite direction of their previous trade. Conversely, if the correlation is negative, the trader will open a trade in the same direction as their previous trade. This technique is used by traders who are confident that the market will move upward in the long term.

In Forex, traders can hedge on all assets, although there may be restrictions depending on their trading account and broker. For example, in the United States, brokers will immediately close both trades if a trader opens a trade in the opposite direction of their original trade on the same currency pair. However, most brokers offering services to all users allow hedging with minimal restrictions. If you are in need of a leading robot in hedge strategy, we suggest you check out the Buy Forex EA page.

In Forex trading, hedging is a technique used to minimize the risk involved in a trade. It is a temporary risk coverage in a trading position. However, it is a high-risk process and should only be used by professional traders who have learned and tested the exact hedging strategy on a demo account. It is advisable to use trading robots that have sufficient trading power and do not require hedging instead of relying on expert advisors that use hedging. If you are interested in learning more about the forex robot; We suggest reading the article “What is a Forex robot?”.

It is advisable to use professional trading expert advisors that are profitable and have minimum risk rather than relying on a hedging strategy. The Alpine EA is a highly accurate and reliable trading EA that offers various plans tailored to meet your investment goals.

CONTACT US

📍 2Frederick Street, Kings Cross, London, WC1X0ND, UNITED KINGDOM

☎ +44 7501 643013

✉ support@xpressadvice.com

NEWSLETTER

SIGN UP FOR EMAIL UPDATES

"*" indicates required fields

©2023 Xpress advice All rights reserved